A study of the mental state of the modern American woman by a Princeton University psychologist has found a powerful link between concerns over financial security and satisfaction with one's life.

In looking toward the future, women who concentrated much of their thinking on financial matters were much less likely to be happy with their lives, according to Talya Miron-Shatz, a postdoctoral research fellow in the Woodrow Wilson School of Public and International Affairs at Princeton. And, contrary to expectations, many of those with such worries had plenty of money by conventional standards, she said, suggesting that there is more at play in obtaining peace of mind than simply having cash.

"Even if you are making a hundred grand a year, if you are constantly worried that you are going to get fired, that you are going to lose your health insurance or that you are simply not sure you are going to 'make it,' you are not going to be happy," Miron-Shatz said. Such concerns, she found, affected a wide variety of women at all income levels.

Conversely, those who didn't fixate on finances like retirement savings, tuition for college or simply making ends meet, reported being the happiest of the group.

The study was published Feb. 25 in Judgment and Decision Making, a scholarly journal. Miron-Shatz is hoping the results might guide policy decisions, especially those being devised by President Barack Obama and the U.S. Congress in the wake of today's financial crisis. Her work would favor a focus on strategies that create social and financial "safety nets" over measures that would directly increase income.

To understand how income and concerns over financial security may relate to a person's satisfaction with life, Miron-Shatz conducted two separate studies of a representative sample of nearly 1,000 American women of various ages and incomes. In one study, she showed that considerations of financial security were as important to the study subjects as their monetary assets.

She asked subjects in the second study to think about the future in an open-ended manner. Those who did so and mentioned financial concerns -- retirement, college tuition, making ends meet, etc. -- were less satisfied with their lives, she found, than those who did not raise such concerns. One of her participants said that when thinking of her future she wondered, "Will I be happy and financially stable?" The stability, Miron-Shatz says, is crucial. "It's not about greed," she added. "It's about knowing whatever it is you have, be it your McMansion or your motor home, won't be taken away from you."

Discussions about wealth need to be expanded to include this notion of financial security, she said, and though valid and meaningful, this factor is "glaringly missing from economic discussions," she said in her paper's introduction.

Psychologists have long sought to understand the connection between money and happiness.

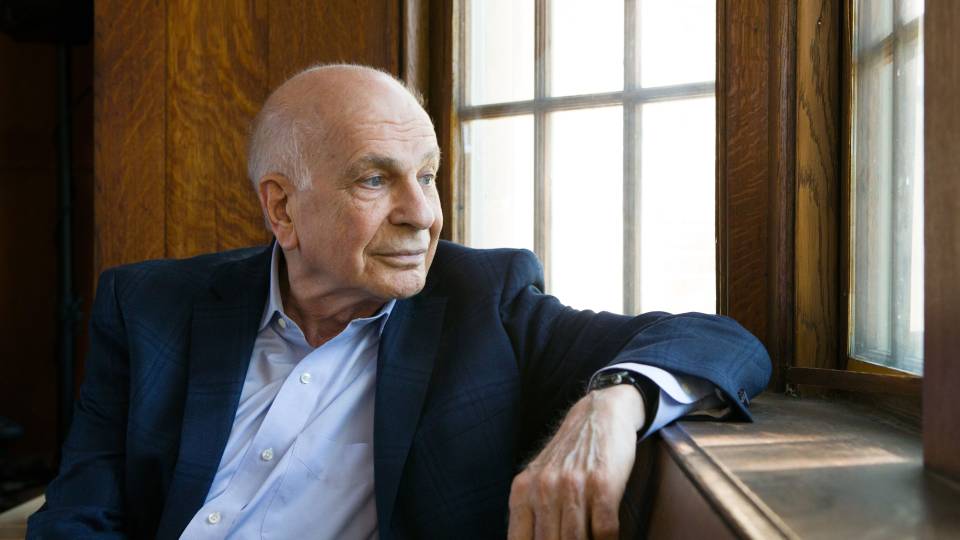

Though the popular conception has been that "money can't buy happiness," studies have shown that wealth can play a role in enhancing happiness. Yet, wealth itself has been poorly defined in studies. And, contributing to this complicated relationship is what Princeton Nobel laureate Daniel Kahneman has called the "satisfaction treadmill." In pioneering studies of human happiness, Kahneman, the Eugene Higgins Professor Emeritus of Psychology, has found that satisfaction does not necessarily increase in a corresponding amount with an improved financial status.

Miron-Shatz is a postdoctoral fellow in the laboratory of Kahneman, a psychologist who has pioneered the integration of research about decision-making into economics and won the 2002 Nobel Prize in economic sciences. Miron-Shatz's paper grew out of her work with Kahneman, who is her adviser.