For many people who follow America's financial markets, it is clear that economic decisions people make are not always rational. A study now offers one neurological explanation: people's choices can depend in part on what region of their brain emerges victorious from a battle between centers of emotional impulse and rational thinking.

In a paper to be reported in the June 13 issue of Science, Princeton psychologists used brain-imaging technology to study people as they made decisions that caused them needlessly to lose money and found that negative emotional states can override logical thinking. The study supports a growing area of research called behavioral economics, which departs from conventional theory by considering psychological factors other than pure logic in individual decision-making.

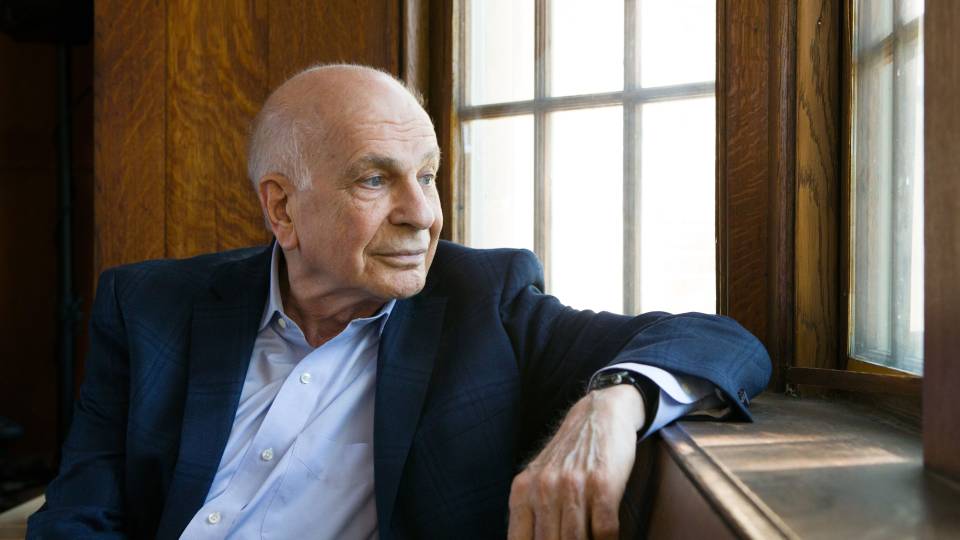

"It is a very important study," said Princeton psychologist Daniel Kahneman, who won the 2002 Nobel Prize in economics for research blending psychology and economics and who is not an author of the study. "It indicates the tremendous promise of this kind of work for behavioral economics and, ultimately, for economics in general."

More details are available in a news release .

Contact: Lauren Robinson-Brown (609) 258-3601